Retail Inventory Method: A How-To Guide

The cost-to-retail ratio determines how much your inventory costs in relation to the retail price. You have to manage employees, build staff schedules, implement marketing strategies, and keep an accurate count of your store’s inventory to ensure you don’t run out of any products. Furthermore, you must ensure you aren’t losing money on sales by correctly calculating your cost-to-retail ratio. Although there are many ways to estimate the value of your stock, the retail inventory method is one of the most common and efficient techniques. This method works by taking the total retail value of all the products in your inventory, subtracting the total amount of sales, and then multiplying that amount by the cost-to-retail ratio. So, while it’s less costly and time-consuming than conducting a physical count of your inventory, it’s also less accurate.

Gain real insight into inventory value

This method is commonly used by businesses that sell inventory with an expiration date, like food and drinks. In fact, you can easily implement it without the need for extensive training or specialized software. Remember to use the wholesale price you paid for the inventory, and not the price you’re charging your customers. The retail method serves as a shortcut to conducting a physical inventory count, but should not replace it. After all, this method isn’t always accurate because losing or damaging a fraction of your stock is unavoidable.

Pros of the retail inventory method

As the value of your inventory decreases, you’ll know that you’re getting closer to your reorder point. The International Financial Reporting Standards require you to use the same costing formula for all inventories of a similar nature. As such, you may not be able to use the retail inventory method if you use multiple costing formulas. That way, you know exactly when your stock levels are running low and when it’s time for you to call in product reinforcements.

Alternatives to the retail inventory method

- Another concern regarding the retail inventory method has to do with demand forecasting.

- Plus, you can save quite a bit of money when your team isn’t working days on end trying to generate a physical inventory count.

- The retail inventory method is an inventory accounting method that lets business owners estimate the value of their inventory for a given time period.

- For businesses with multiple locations or stores, maintaining consistency when you’re valuing inventory can be a challenge.

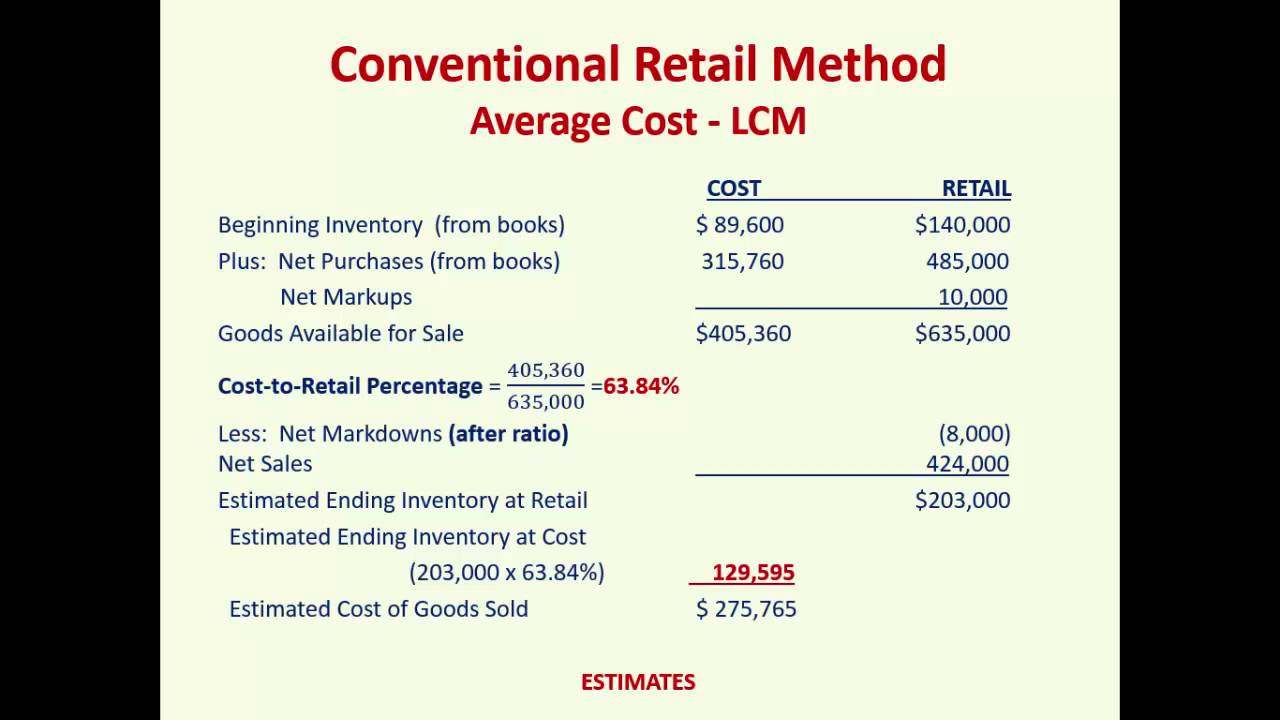

The cost-to-retail percentage formula isn’t just a bunch of numbers strung together; it’s a reflection of your business’s financial health. At its core, this formula captures the relationship between the cost of goods sold (COGS) and total sales revenue. For instance, if the company from the example in Section 2 had $90,000 in total sales over the period, the retail value of its ending inventory would be $100,000 minus $90,000, or $10,000. The cost of its ending inventory would be equal to $10,000 times the cost-to-retail ratio of 50 percent, or $5,000.

How to keep on top of your inventory with Cogsy

Your inventory value would be $70 since there were 10 bags left that you bought for $1 and 30 left that you bought for $2. When retailer Borrego Outfitters needed a new POS solution that could scale with their operations, they turned to Lightspeed. With Lightspeed’s intuitive inventory management solution, they can manage their vast product catalog much more efficiently.

Weighted average cost method

Having a handle on your inventory is an important step in managing a successful business. Then, you decided to buy 100 more water bottles which cost you $12 each, totaling up to $1,200. With the LIFO method, the cost of goods sold would be $90 since the last 20 basketballs you purchased cost $6 dollars each.

We now have the closing inventory at cost and can use the standard formula to calculate the cost of sales. Unlike methods that require meticulous tracking of each individual item, the retail inventory method reduces the need for extensive record-keeping or auditing. All retailers are different, and the retail inventory method is an optimal accounting strategy for specific types of retailers. cost to retail ratio Although the retail inventory method has a lot of benefits, there are some drawbacks to be aware of. First of all, it’s important to understand that it’s just an estimate and doesn’t account for items that are stolen, broken, or otherwise taken out of inventory for reasons other than a sale. One of the main benefits of the RIM is that it supports you in exercising inventory control.

For best results, use the retail inventory method only when the products you’re appraising have the same markup. For example, this method won’t work if you’re calculating the value of jeans that have a 50% markup and pencils that have a 150% markup. Since the retail inventory method only gives an estimate of your ending inventory value, it’s not the perfect substitute for physically counting and reconciling inventory. Furthermore, the retail inventory method works best when the markup is consistent across all your products. If different products carry different markups, the end result won’t be completely accurate.

Below you’ll find a breakdown of the retail inventory method formula, in addition to 3 retail valuation methods that can impact this process. Using the retail inventory method saves retail operators and merchants the time and expense of shutting down for a period of time to conduct a physical inventory. Adopting the retail inventory method can help owners get a more regular sense of what’s available. By accurately setting up inventory and accounting logistics, business owners can better manage operations and continue to grow.