About the Insurance contracts guide

The FASB issued its exposure draft of targeted improvements in September 2016, and is currently redeliberating based on the comments received. There are benefits for companies that take advantage of this opportunity to gain new insights from data analysis and reporting and to improve process efficiency. With a change of this magnitude, companies should be motivated to invest in solutions that achieve efficiencies.

Business Owners Policy vs. Commercial Package Policy: Which One Better Suits Your Business’s Insurance Needs?

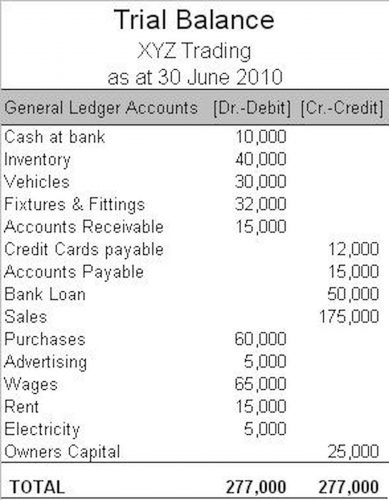

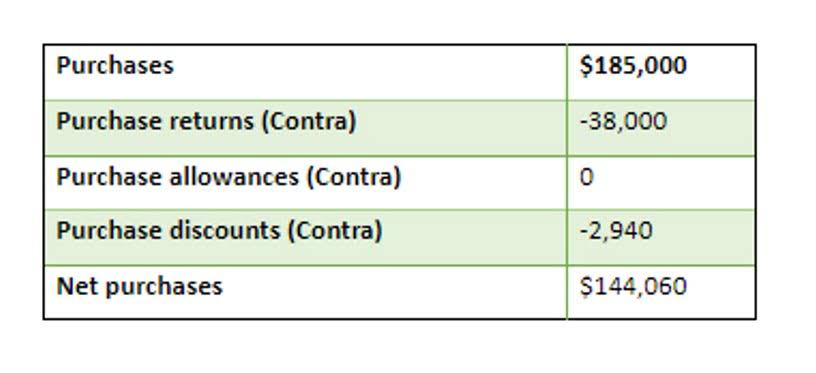

Enhance your proficiency in insurance accounting including how to interpret financial statements, so you can better understand the connection between an insurer’s financial statements and its success. The second largest asset category for property/casualty companies, preferred and common stocks, is valued at market price. Life insurance companies generally hold a small percentage of their assets in preferred or common stock. The Table of Differences describes the relationships between UK and Ireland financial reporting standards and IFRS Accounting Standards. The information provided on this website does not constitute insurance advice. All content and materials are for general information or illustrative purposes only.

- About the same time, the European Union (EU) started work on Solvency II, a framework directive aimed at streamlining and strengthening solvency requirements across the EU in an effort to create a single market for insurance.

- Upholding these best practices on top of running your own insurance agency might seem impossible—after all, there are only so many hours in a day.

- A company applying IFRS 17 will need to remeasure its estimates each reporting period using current assumptions, which could require significant effort and new processes and controls.

- In recent years clients adding technology and the accountants’ involvement adds a new level of exposure.

- In effect, surplus calculated this accounting system requires an insurer to have a larger safety margin in its policyholder surplus levels to be able to fulfill its obligation to those policyholders.

- Additionally, many US insurers may have the extra effort of potential changes to the accounting and disclosures for long-duration insurance contracts under US GAAP, and statutory accounting requirements under principles-based reserving requirements.

Navigating the Complex Landscape of Accounting in Insurance

All insurance companies are required to use statutory accounting when preparing their financial statements because of the risky nature of the industry. This risk is due to the fact that insurance companies are wagering that only a small number of policyholders are going to need to collect on their coverage amounts and that their revenue from policy sales will cover Insurance Accounting these payouts. However, if the payouts exceed the amount of liquid assets the company has, it may have to file bankruptcy and potentially even be dissolved completely. In the ever-evolving landscape of the insurance sector, understanding the accounting aspects is not just about compliance and number crunching; it’s about grasping the industry’s heartbeat.

Investment Accounting for Insurance Companies

- With the bar being set so high, it’s pretty easy to see why claims are alleged against CPA firms so frequently.

- At best, these issues result in a distraction and are likely to involve legal fees.

- Generally, this will result in the grouping of contracts for presentation purposes below the portfolio of insurance contracts level as some companies may do now.

- When creating their risk management program, accounting firms need to consider a variety of potential exposures.

- The realm of accounting in the insurance industry is intricate and multifaceted, playing a pivotal role in insurance companies’ operational and financial stability.

- Thankfully, workers’ compensation probably won’t cost your accounting firm a lot, since an office is not a high-risk workplace.

Ideally, a set of universal accounting principles would facilitate global capital flows and lower the cost of raising capital. Some 100 countries now require or allow the international standards that the IASB has developed. Being able to group contracts to apply the general measurement model may require significant effort and changes in how insurance contracts are measured and how their results are reported to users. Some companies may currently measure insurance contracts at a level (e.g. portfolio level) that includes both profit-making and loss-making contracts, thereby offsetting losses and gains. When applying the grouping requirements of IFRS 17, these contracts will no longer be able to be grouped. Accordingly, the effect of loss-making contracts will be recognized in profit or loss immediately, but the expected profit from profit-making contracts will be recognized as service is provided (i.e. over the expected life of the contract).

- Regulatory compliance and reporting are fundamental aspects of accounting in the insurance industry.

- In times of uncertainty and financial stress, it seems increasingly important for the insurance sector and broader financial services industry to maintain connections and be well-positioned to serve clients.

- Whether you or someone in your firm makes a mistake in the course of providing professional services, insurance can help make sure that your personal assets are properly protected.

- Separately, the general measurement model is modified (mandatory) for the measurement of reinsurance contracts held, direct participating contracts and investment contracts with discretionary participation features.

Professional services firms are also strongly encouraged to get third-party coverage to protect against claims coming from outside the firm, such as claims made by clients. Having correct insurance accounting principles in place is the first step to a more stable financial future. With these insurance accounting basics in your pocket, you’re better prepared to take on the financial responsibilities of running your insurance agency and upholding your duty to your policyholders. Under IFRS 4, a US company that applies IFRS may account for insurance contracts using US GAAP. That will no longer be an option under IFRS 17, which means that dual reporters will need to maintain at least two different sets of financial reporting records upon adoption of IFRS 17 because of the different accounting models. Applying the general measurement model will require companies to track certain historical information to determine the contractual service margin (e.g. tracking of discount rates to determine the present value of estimates of future cash flows).

Unique Transactions That Apply to Insurance Accounting

Understanding these principles is important for correctly implementing statutory accounting at your business. Member firms of the KPMG network of independent firms are affiliated with KPMG International. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. Implementation efforts for IFRS 17 will vary depending on the systems, methods and data storage capabilities currently used to measure and track insurance contracts, account for, report and disclose related information. A company applying IFRS 17 will need to remeasure its estimates each reporting period using current assumptions, which could require significant effort and new processes and controls.

An insurance company’s annual financial statement is a lengthy and detailed document that shows all aspects of its business. An insurance company’s policyholders’ surplus—its assets minus its liabilities—serves as the company’s financial cushion against catastrophic losses and as a way to fund expansion. Regulators require insurers to have sufficient surplus to support https://www.bookstime.com/ the policies they issue. The greater the risks assumed, and hence the greater the potential for claims against the policy, the higher the amount of policyholders’ surplus required. Statutory Accounting Principles are designed to 1) ensure consistent reporting among insurers, and 2) assist state insurance departments in the regulation of insurance companies.